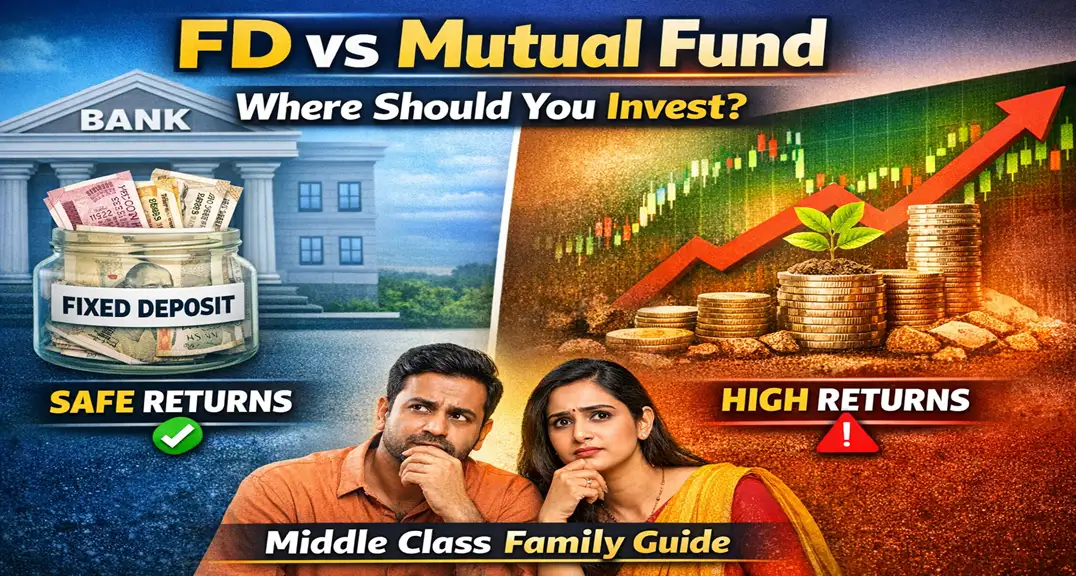

When it comes to saving and growing money, every middle class family in India asks the same question:

👉 Should I put money in a Bank FD (Fixed Deposit) OR invest in Mutual Funds?

Both options are popular — but they are very different in terms of returns, risk, liquidity, and tax. A Fixed Deposit provides safety and guaranteed returns, while Mutual Funds offer higher growth potential but come with market risk.

This article will help you understand the real difference between FD and Mutual Funds, so you can make the best financial decision for your family.

What Is a Fixed Deposit (FD)?

A Fixed Deposit (FD) is a financial product offered by:

✔ Banks

✔ Non-Banking Financial Companies (NBFCs)

You deposit a certain amount of money for a fixed time period and get:

✔ Guaranteed interest

✔ Assured return on maturity

Example:

If you invest ₹1,00,000 in FD at 7% annual interest for 3 years, you will get:

➡ Principal + interest at the end of 3 years

FD is one of the safest investment options in India.

What Is a Mutual Fund?

A Mutual Fund is a pooled investment managed by experts (fund managers).

When you invest in a mutual fund, your money is combined with other investors and invested in:

✔ Stocks

✔ Bonds

✔ Government securities

✔ Corporate debt

There are many types of mutual funds:

- Equity Mutual Funds (stocks)

- Debt Mutual Funds (bonds)

- Hybrid Funds (mix of equity + debt)

- ELSS (Tax saving mutual fund)

Unlike FD, returns are not guaranteed and depend on market performance.

High GT Viral Video Why This Clip Is Trending Worldwide on Google

Marion Naipei viral video: The incident has gone viral on social media.

Vera Hill Viral Video Link: Why the Internet is Searching for This New Social Media Trend

James Opande Viral Video Link: US-Based Medic Detained in Nairobi Over Leaked Clip Controversy

DGP Ramachandra Rao Viral Video: Karnataka CM Orders Probe After Alleged Clip Surfaces Online

Mumbai Ke Suresh Ki Viral Video: Who Is the ‘Viral Bhabhi’? Truth Behind the Trending MMS

Ajaz khan latest viral mms Full Video Direct link To Download

Sir Please Viral Video Original Link” Dowload Video Direct Link Here

FD vs Mutual Fund: Comparison Table

| Feature | Fixed Deposit (FD) | Mutual Fund |

|---|---|---|

| Risk | Very Low (Safe) | Medium to High (Market linked) |

| Returns | Fixed & Guaranteed | Variable (Depends on market) |

| Liquidity | Moderate (Penalty for early withdrawal) | High (Can redeem anytime) |

| Taxability | Interest fully taxable | Depends on holding period & type |

| Best For | Risk-averse investors | Long-term growth seekers |

| Minimum Amount | ₹1,000 (usually) | ₹100 (via SIP) |

Returns: FD vs Mutual Funds

Fixed Deposit Returns

FD interest rates in India range approximately:

📈 6% – 7.5% per annum

These returns are secure, but after inflation and tax, the real gains may be low.

Example:

Investment: ₹1 lakh

Rate: 7% p.a.

Maturity after 3 years: ₹1,22,500 approx.

Mutual Fund Returns

Mutual fund returns are not fixed:

✔ Equity funds may give 10% – 18% or more (long term)

✔ Debt funds may give 6% – 8%

Example (Equity Mutual Fund):

Investment: ₹1 lakh

Time: 5 years

Annualized return: ~12%

Final value: ₹1,76,000 approx.

⚠ Remember: Past performance is not a guarantee of future returns.

Risk Comparison

🛡 Fixed Deposit Risk

✔ Principal safety

✔ No market fluctuations

✔ Full return guaranteed

📉 Mutual Fund Risk

✔ Market risk (downs & ups)

✔ Equity funds more volatile

✔ Debt funds less risky but not guaranteed

Tax Treatment: FD vs Mutual Funds

💰 Tax on Fixed Deposit

Interest earned on FD is fully taxable as per your income tax slab.

Example:

If you are in 20% tax bracket and earn ₹7,000 interest, tax will be ₹1,400.

💹 Tax on Mutual Funds

1. Equity Funds (Securities Transaction Tax + LTCG):

✔ Holding > 12 months → 10% tax on gains above ₹1 lakh

✔ Holding ≤ 12 months → 15% tax on gains

2. Debt Mutual Funds:

✔ Holding > 36 months → 20% tax after indexation

✔ Holding ≤ 36 months → Taxed as per income slab

👉 Mutual funds can be tax-efficient compared to FDs if held long term.

Liquidity & Accessibility

🏦 Fixed Deposit

✔ Premature withdrawal possible

✔ But penalty may apply

✔ Less flexible

📊 Mutual Funds

✔ Quick redemption

✔ No penalty (usually 2–3 days to receive money)

✔ More liquid than FD

Which One Is Best for Middle Class Families?

✔ Choose FD If:

✔ You want zero risk

✔ You prefer guaranteed return

✔ You need short-term safe parking

Best for:

➡ Senior citizens

➡ Low-risk investors

➡ Emergency funds

✔ Choose Mutual Funds If:

✔ You want higher long-term growth

✔ You can tolerate market ups & downs

✔ You want inflation-beating returns

Best for:

➡ Wealth building

➡ Long-term goals (kids’ education, retirement)

➡ People comfortable with markets

Hybrid Approach (Best of Both)

Most middle class families benefit from a mix of both:

📌 Emergency fund → Fixed Deposit

📌 Long-term goals → Mutual Funds (SIP)

📌 Safe portion → Debt funds

📌 Growth portion → Equity funds

This balances safety + growth + liquidity.

How to Start Investing (Step by Step)

1. Set Your Goal

Examples:

- Emergency fund: ₹50,000

- Kids’ education: ₹5,00,000

- Retirement: ₹20,00,000

2. Decide Timeframe

- Short term (<3 years) → FD / Debt fund

- Long term (>5 years) → Equity mutual funds

3. Open Investment Account

✔ Bank FD → Through your bank

✔ Mutual Funds → Through AMC, broker app, or online platform

4. Invest Regularly

For mutual funds, use SIP (Systematic Investment Plan) to build habit.

5. Monitor Annually

Check if returns are meeting your goals — rebalance if needed.

Real Example: Middle Class Family Plan

👨👩👧 Mr. & Mrs. Sharma, Income: ₹50,000/month

Investment Goal: ₹10 lakh in 7 years

Strategy:

- ₹2 lakh in FD (safety)

- ₹3,000/month SIP in equity mutual funds

- ₹1 lakh in debt mutual funds

Estimated value after 7 years:

- FD: ₹2.4 lakh

- Mutual funds: ₹5+ lakh

- Total: ₹7+ lakh (growth + safety)

(This is just an example — actual returns vary)

Frequently Asked Questions (FAQ)

Q1. Is FD better than mutual funds for beginners?

✔ Yes for safety, ✘ No for growth.

Q2. Can I switch mutual funds to FD anytime?

✔ Yes, you can redeem and move to FD.

Q3. Do mutual funds guarantee returns?

❌ No, market linked.

Q4. Should I use SIP or lumpsum in mutual funds?

✔ SIP is safer for beginners.

Q5. Can mutual funds lose money?

✔ Yes in the short term, but long term usually grows.

Conclusion

For middle class families in India, the choice between FD and Mutual Funds depends on needs:

✔ FD = safety + guaranteed returns

✔ Mutual Fund = higher growth potential + market risk

Best way is to balance both:

Use FD for safety, and mutual funds for long-term growth.